Weekly Forecasts 39/2025

Bitcoin through the lens of on-chain metrics.

Bitcoin has been on juice, recently breaking into all-time highs around $125,000, then sitting back comfortably on the 110k price level.

With prices surging and falling, it’s a good time to take stock of what’s happening under the hood of the market. In this section, we’ll walk through four key charts that illustrate the current state of Bitcoin, from trading activity and investor sentiment to institutional flows and retail participation. Each chart tells a part of the story of where the market stands now and what it could mean in the short and long term.

Mate

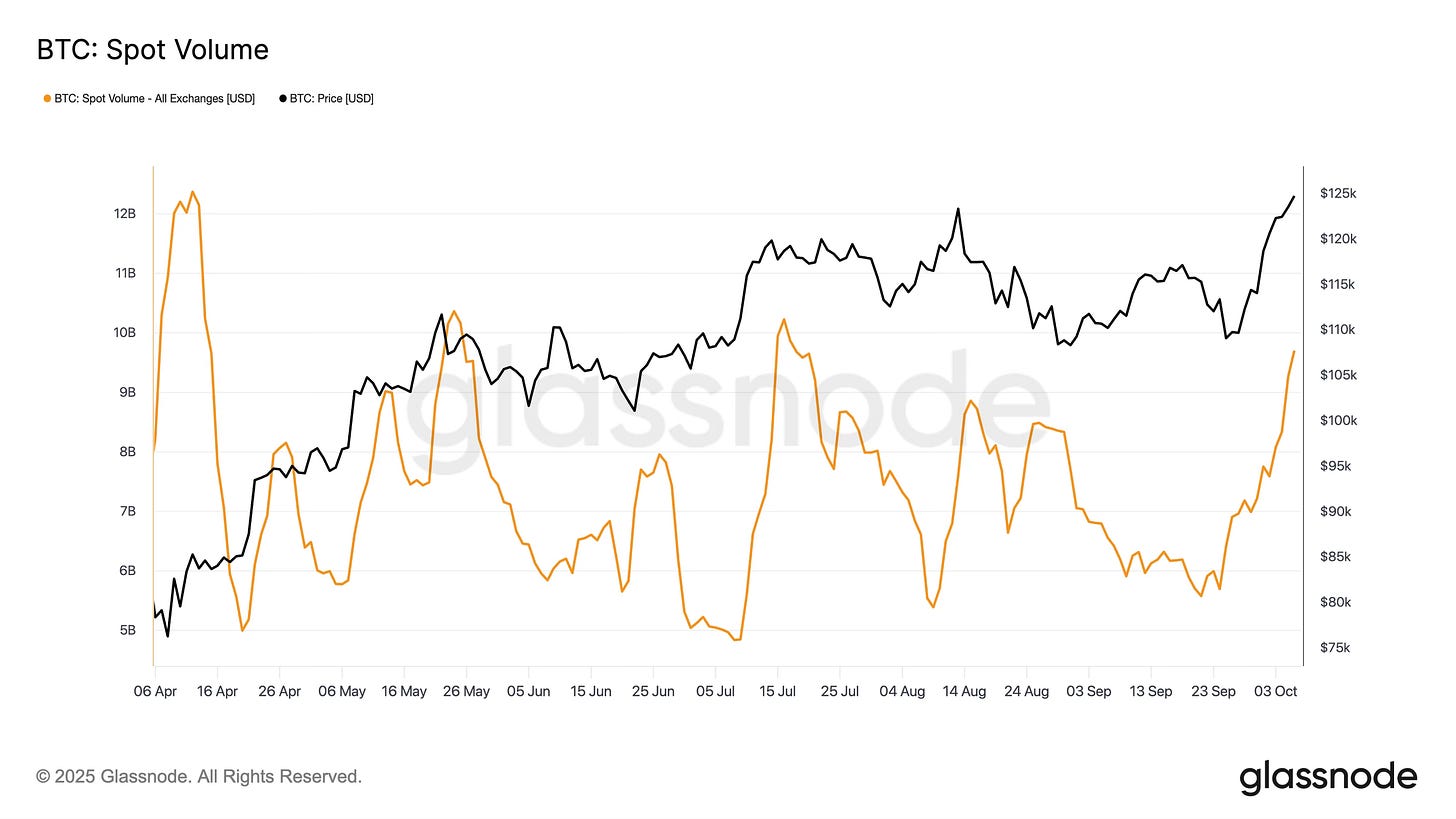

Trading Volumes Are Soaring

Bitcoin’s trading activity has roared back to life. After a relatively quiet period earlier in the year, spot volumes on exchanges have climbed to their highest levels since spring, coinciding with Bitcoin’s price breakout to new highs .

In simple terms, more volume means more interest and liquidity – a healthy sign for the rally. High trading volume indicates that plenty of buyers and sellers are active, which can make price moves more robust. The recent surge in volume confirms renewed market participation and deeper liquidity supporting the uptrend . The key takeaway: this rally isn’t happening on thin air – it’s backed by significant trading activity. As long as volumes remain strong, it suggests the market has momentum. If volumes were to suddenly dry up, that could signal waning enthusiasm, but right now participation is vibrant.

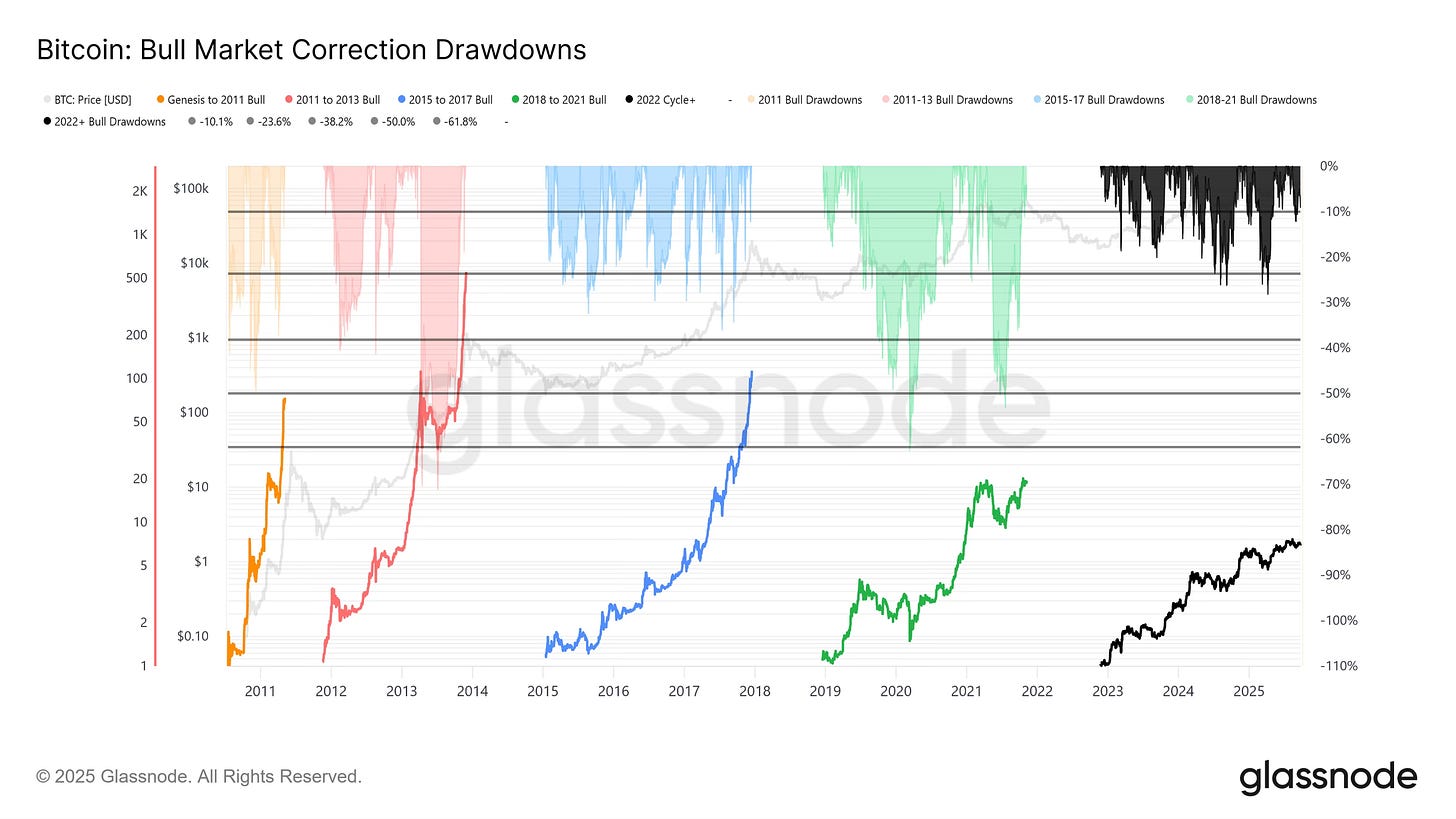

Bull‐Market Dips Have Been Shallow

Even bull markets aren’t a straight line up – but this cycle’s pullbacks have been milder than before.

The chart below illustrates drawdowns (price drops from local highs) during Bitcoin’s various bull runs. Each colored area shows how deep each correction went. Notably, in prior bulls we saw multiple corrections over -30% or even -50% (see the red, blue, and green zones for 2013, 2017, and 2021 cycles).

This time around, the declines have been less severe. According to on-chain data, the largest dip in the current 2022–25 uptrend was about -32% in August 2024, and most pullbacks have been on the order of 20–25% . These smaller drawdowns reflect a more resilient market, likely bolstered by strong buyers (for example, spot ETF demand and institutional interest helping absorb selling) . For investors, this is a double-edged sword. On one hand, shallower corrections have made the ride upward less volatile and suggest robust support – a sign of a maturing market. On the other hand, it’s wise to remember that dips still happen in bull runs. A 20% drop from a new high can feel scary if you’re not expecting it, but history shows it’s normal. The relatively modest pullbacks so far indicate healthy “breathers” in an ongoing uptrend, but don’t be shocked by periodic corrections. They’re a feature, not a bug, of Bitcoin’s market cycles.

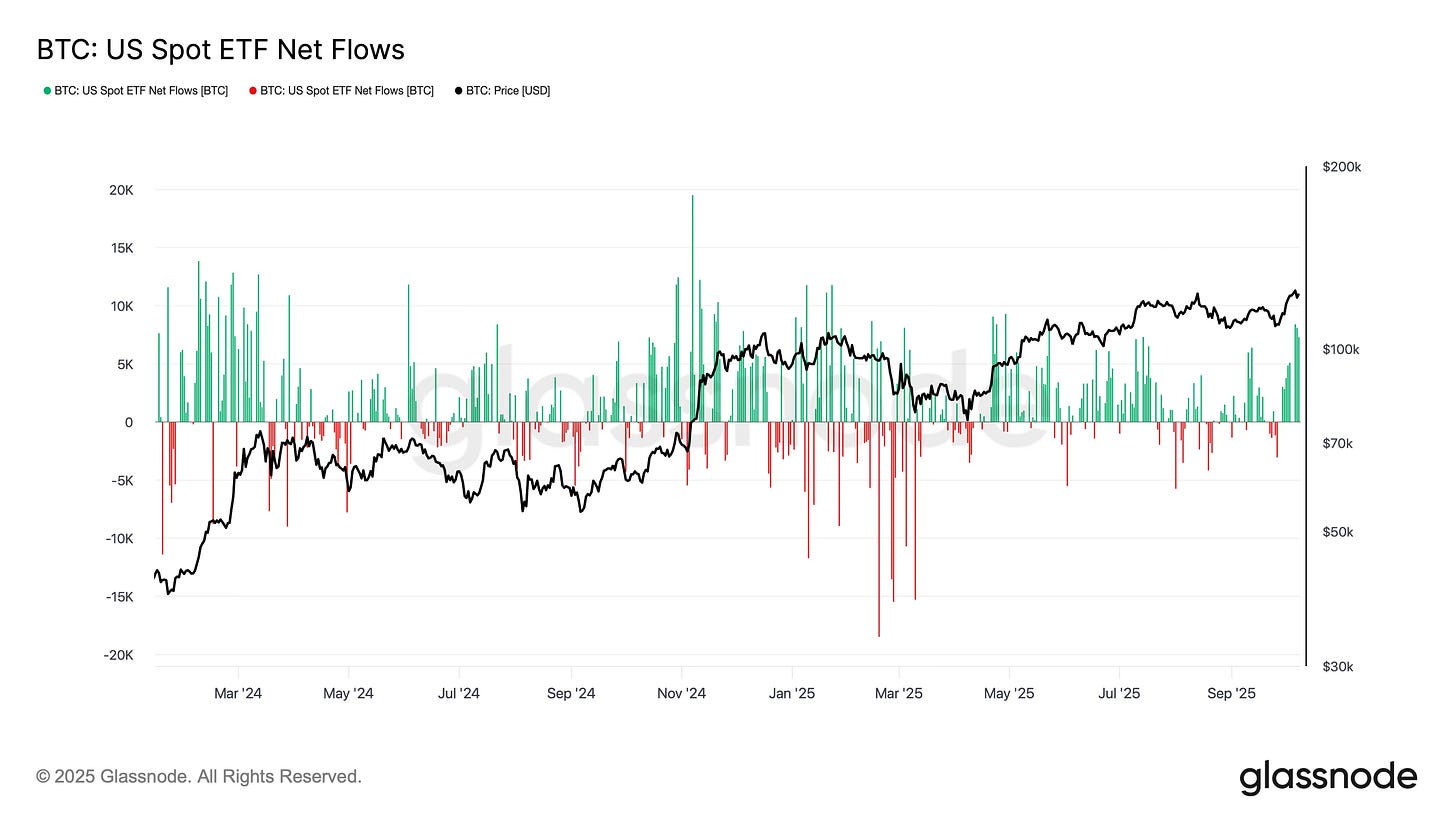

Institutions Are Piling In

Big money is flowing into Bitcoin through new investment vehicles. In late 2024, the first U.S. spot Bitcoin ETFs launched, and they’ve quickly become a significant channel for investment. The green bars above zero show inflows (money coming into these ETFs), while red bars below zero show outflows.

The recent trend? Huge inflows. In fact, October 2025 has seen a wave of buying via spot ETFs on the order of billions of dollars. On-chain data shows that over $4.8 billion flowed into U.S. spot Bitcoin ETFs just this month, one of the strongest bursts of institutional buying since the spring . These ETFs make it easier for traditional investors (from hedge funds to retirement funds) to get Bitcoin exposure, so positive net flows indicate rising institutional and mainstream adoption. What does this mean for the market? For one, these inflows add buying pressure and soak up available supply (the ETFs have to purchase actual BTC). This was a key driver cited for Bitcoin’s October breakout, because strong ETF demand helped propel the price to record levels . It also suggests that institutions are increasingly confident in Bitcoin’s prospects (or at least fearful of missing out). As long as we continue to see hefty green bars (and occasional red ones), it implies sustained support for prices from big players. The flip side: if we ever see a surge of red bars (outflows), that could put short-term pressure on the market. But right now, the institutional bid is robustly positive, clearly a bullish sign for the market.

Retail Activity is Finally Picking Up

After sitting on the sidelines for much of the early rally, retail traders are now rushing back in. This on-chain metric tracks how active smaller retail investors are in the spot market, based on how frequently they’re trading. In the chart above, red and orange dots signify periods of “many” or “too many” retail traders active, whereas green indicates relatively few retail participants.

You can spot clusters of red/orange during the peaks of 2017 and 2021 – classic moments of retail frenzy. Until recently, the current bull run hadn’t seen the same level of small-trader frenzy (in mid-2025, observers even called the network a “ghost town” for retail activity). But that’s changing: a surge of retail trading is now underway as Bitcoin streaks upward. The most recent dots on the chart turning red suggest retail FOMO is kicking in – many newer or smaller investors are trading frequently again. Historically, retail enthusiasm tends to reach its highest levels near market tops, when the hype is maximal . Does that mean we’re at the final top now? Not necessarily. But it is a hallmark of a late-stage bull market that mom-and-pop investors are flooding back. In the short term, this influx of retail money can further fuel the rally (more buyers = more demand). It also makes the market sentiment more exuberant. The clear takeaway is that the general public is rediscovering Bitcoin in force, which is both a sign of how far this rally has come and a reminder to remain level-headed. When everyone and their taxi driver is trading crypto (the kind of story we heard in late 2017), it’s wise to stay disciplined. For now, though, retail participation is strengthening the uptrend, not derailing it.

Conclusions

Bringing it all together, the current Bitcoin market in October 2025 is showing impressive strength on multiple fronts. Trading volumes are robust , indicating solid engagement behind the price gains. Sentiment is mostly bullish but not yet at extreme bubble levels . We see that this bull cycle’s corrections have been relatively mild , thanks in part to new structural support like ETF-driven buying and broad-based accumulation. Indeed, institutions have entered the fray in a big way, pouring billions into Bitcoin ETFs and helping to “soak up” supply . And now, even the retail crowd, which had been surprisingly quiet, is joining the party, adding the kind of energetic momentum typical of a late bull run.

All these factors paint a picture of a market that is fundamentally robust and near all-time highs, yet not showing the classic signs of final-cycle exhaustion just yet. For example, nearly 97% of the Bitcoin supply is in profit at today’s prices, a level that usually only happens toward the end of bull markets, but on-chain data suggests we haven’t hit an “exhaustion peak” in profit-taking . Investors are still mostly accumulating or holding, and profit-taking remains orderly rather than panicked (except yesterday) . That said, caution is warranted going forward. Leverage in the system is growing (funding rates and futures open interest are up), and as we’ve noted, sentiment and retail fervor are rising, and these can introduce volatility. It’s wise to expect continued twists and turns even if the macro trend stays positive.

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as an investment advice. GnS Economics nor any of the authors cannot be held responsible for errors or omissions in the data presented. Readers should always consult their own personal financial or investment advisor before making any investment decision, and readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor any of the authors cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.