Weekly Forecasts 30/2025

Personal consumption and industrial production as drivers of bank lending in the U.S.

Forecasts:

The role of personal consumption expenditures and industrial production in U.S. bank lending.

Cointegration analysis of variables affecting U.S. bank lending.

Impulse-response analysis.

Forecasts for U.S. bank lending.

In these weekly forecasts, we walk you through a statistical forecasting process concerning U.S. bank lending. I have been conducting statistical analyses since 2003, when I started my Master’s Thesis (on the effect of income inequality on economic growth). What I will present here is a standard practice of how statistical analyses leading into forecasts are (should be) conducted.

Since we started to present time-series forecasts, we have been concentrating on finding variables of interest that could be forecasted using simple models, possibly including only the lagged values of the variable in question. We have done this simply to save time and effort. Handling the model becomes easy when we can forecast a variable reliably using only a limited subset of other variables. Unsurprisingly, we have found only a strictly limited set of such variables, namely the OECD’s leading indicators. With them, it appears that the dynamic interactions between a very limited number of the leading indicators of different countries would provide enough information for producing reliable forecasts. We will know whether this holds within the next six months.

In this report, we conduct our first pass of finding the variables driving the loans and leases series and the commercial and industrial loan series of U.S. banks. We have been concentrating on these two series because overall bank lending drives both investments and consumption and because business loans drive the investments of firms (mostly SMEs). These factors contribute significantly to economic growth.

We are able to discover some of the variables that hold (statistical) predictive information on U.S. bank lending. The forecasts indicate that bank lending in the U.S. would recover, contradicting our H1 U.S. recession call. However, there are, again, issues with the forecasts they produce. More work thus lies ahead to produce a reliable forecast for U.S. bank lending.

Tuomas

Preliminary analysis: Consumption expenditures and industrial production

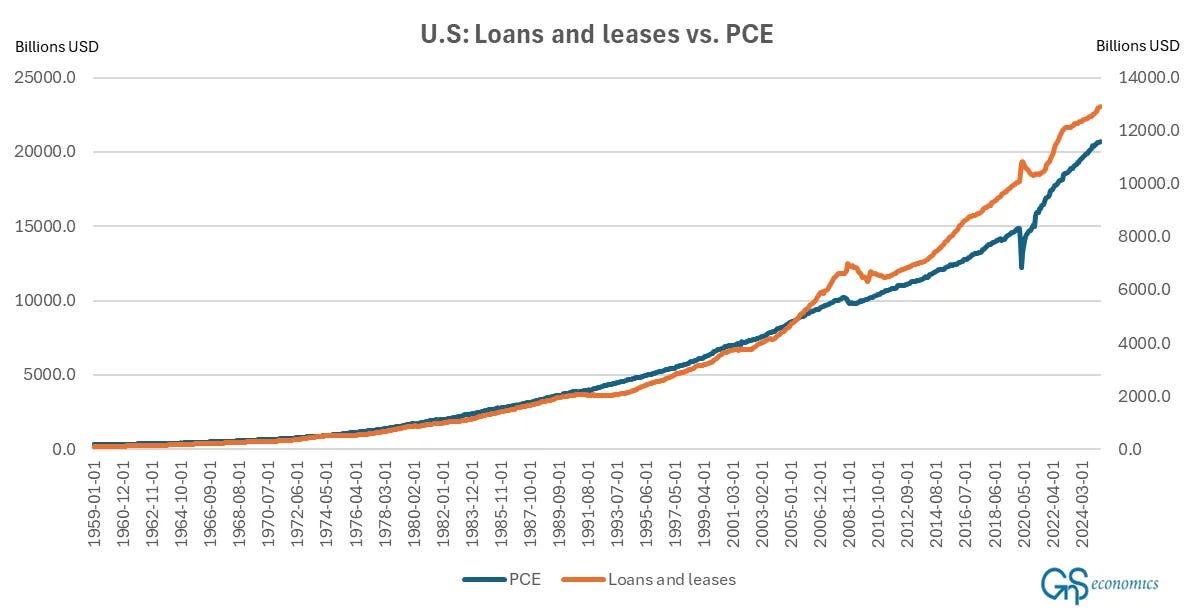

Theoretically, the personal consumption expenditures of U.S. households could potentially influence the loans and leases issued by U.S. banks. This is simply because personal consumption expenditures, henceforth PCE, naturally reflect both the actual consumption of households, but possible also their potential consumption intentions. That is, PCE may also hold information on how households are going to spend and thus lend in the future. This implies that PCE could be used to forecast the development of loans and leases (from now on LL) given out by U.S. banks. Here are the time series of the two variables.

As we can see from Figure 1, the two series seem to move through time hand-in-hand. As we know, this implies that a long-run steady state (cointegration) relationship could exist between the two variables if they are driven by stochastic trends. Below, we discover this to be the case. So, in this case our theorization hit its mark.

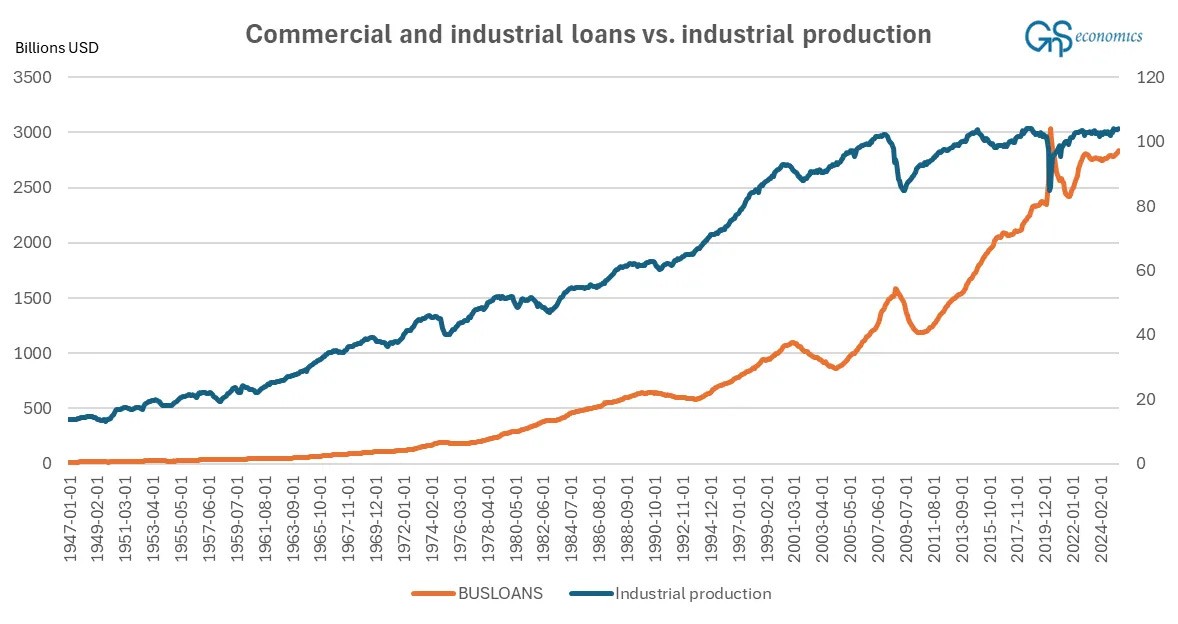

What about commercial and industrial loans? The obvious candidate to explain their development would be industrial production. Increasing industrial production requires funds, which need to be obtained either from commercial banks or the capital markets. This is how the series of the industrial production index (by the Federal Reserve) and C&I loans look in the U.S.

The relationship between commercial and industrial loans (C&I) and industrial production (IP) appears much less clear-cut. While the two series seem to move in something of a tandem from 1947 until 2010, some time after the GFC (Great Financial Crisis), their relationship changes. We wrote “sometime,” because the timing of the structural break in their relationship is not clear. In statistical jargon, “structural break” means simply that something fundamental occurs in the statistical (possibly cointegrating) relationship between two, or more, variables. This “something” is so major that it changes the data-generating process of one or all of the variables.1 This indicates that we could end up with an erroneous conclusion, e.g., concerning cointegration between the variables, if we were unable to take this break into account in a proper way.

Therefore, our visual analysis confirms that personal consumption expenditures and the series of loans and leases move in tandem through time, while the relationship between commercial and industrial loans and industrial production is less clear. Let’s now turn to more sophisticated methods to analyze these relationships.

Unit roots and cointegration

The variables we include in our analysis are: loans and leases (in bank credit), commercial and industrial loans, total assets of banks, personal consumption expenditures, and industrial production. We take natural logarithms on loans and leases, C&I loans, total assets, and personal consumption expenditures to smoothen out their distribution. We leave Industrial production as it is, because it is an index. If we would be taking a logarithm out of it, we would be taking an index (logarithm) out of an index. This makes very little sense and it would risk biasing the distribution of the variable.

We ran the ADF unit root test for all the variables, and it found all of them to have unit roots. Below you will discover an autocorrelation function of (ln) loans and leases up to 36 lags. You can see immediately that the memory of the series is very long (the autocorrelation does not die away). This is a clear indication that the series is a stochastic trend (unit root) process.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Forecasting to keep reading this post and get 7 days of free access to the full post archives.